Welcome to next level financial wellness and planning technology for your well-being

Our Mission: Improve the well-being of families by reducing financial stress.

Practical Tools For A

Complex World

Financial Wellness Assessment

Take our 6-minute assessment to instantly identify your financial strengths, risks, and stressors.

Personalized Report Card

Receive a detailed, confidential report showing your current standing and prioritized next steps.

Curated Education Library

Explore videos, courses, and quick guides built for busy clinicians—covering topics like debt, insurance, savings, and retirement.

Live & On-Demand Support

Join fpGuides™ sessions, webinars, or group office hours to get real answers from financial experts.

Institutional Resources

For program directors and wellness officers: access toolkits, communication templates, and rollout guides.

A Central Hub For

Financial Wellness

Improve your well-being of by reducing financial stress.

“Personal finance should not be a taboo topic in well-being.”

— Brian Case, Certified Financial Planner®

A Complete Picture of Your Wellbeing

Go beyond surface-level advice with tools designed to help you improve your life in meaningful, sustainable ways.

Personalized wellbeing assessment

Clear, easy-to-understand insights

Actionable steps you can apply immediately

Educational content to build confidence and clarity

Ongoing tools to support long-term growth

Foundational Financial Planning

Save more

Households with financial plans are 2.5x more likely to save enough for retirement.

Feel better

83% of individuals with financial plans feel better about their finances after just one year.

Reach goals

Households with financial plans set and reach meaningful goals and milestones.

Better relationships

Individuals with a financial plan have a better relationship with themselves and others.

Improve decisions

Households with financial plans make better financial decisions with confidence.

Increase productivity

Individuals with financial plans are more productive while at work.

Free Resource Hub

Basic RESOURCE HUB ACCESS

5–10 Minute Financial Health Assessment

A confidential, next-level assessment that requires no personally identifiable information and delivers a clear snapshot of your financial health.Personalized Financial Health Report Card

Instantly receive grades across the core areas of personal finance, helping you see strengths, gaps, and priorities at a glance.Curated Financial Literacy Courses

Access education modules selected specifically for your results, so you’re not overwhelmed with generic content.Foundational Planning Tools & Modules

Guided planning tools and modules that help you prioritize goals and understand key financial decisions.Next-Step Action Items

Get clear, practical next steps based on your report card—designed to move you forward without pressure or product sales.Private, Conflict-Free, Self-Guided

Explore planning and education on your own terms, with unbiased tools built to support clarity—not sell products.

Free

Solutions For You

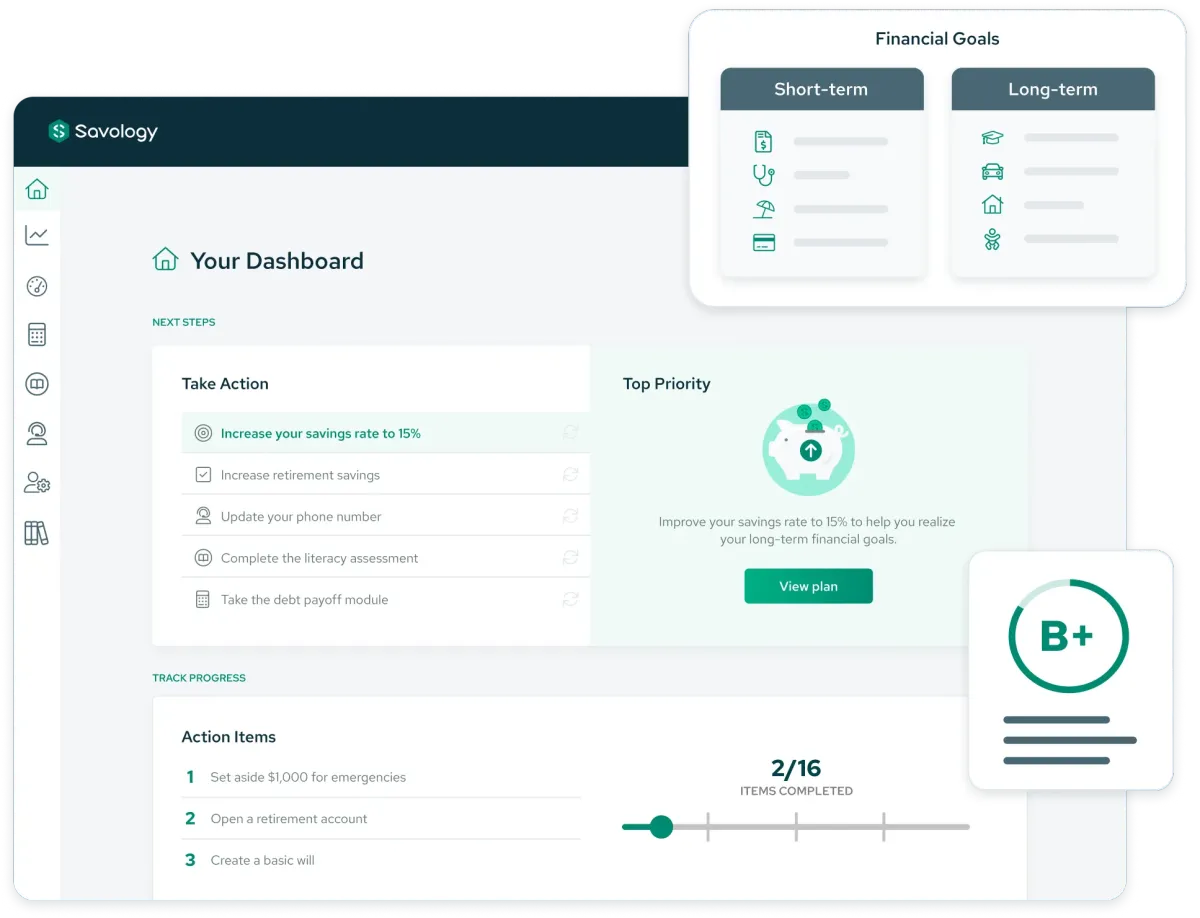

Savology provides a next-level, personalized financial assessment that complements high-level burnout and turnover assessments, such as the Well-Being Index, developed by the Mayo Clinic.

The assessment takes less than ten minutes to complete (6 minutes on average) and does not require sharing any personally identifiable information.

You immediately receive a report card providing grades across all aspects of personal finance.

The report card curates a robust learning management system with physician-specific content.

You also receive action items specific to your situation without bias or conflicts of interest.

From there, you can explore dozens of financial planning tools and set up a dashboard to track your progress and make informed decisions – either independently or with guidance from our team of experts.

Conflict-Free Tools & Resources

Unfortunately, the misaligned financial incentives of many financial advisors often cause a feeling of “being sold” and do not foster trust.

Our tools and resources do not lead to any specific product recommendations.

Instead, our goal is to develop educated consumers who are confident and capable of navigating the complex universe of options for implementing their plans.

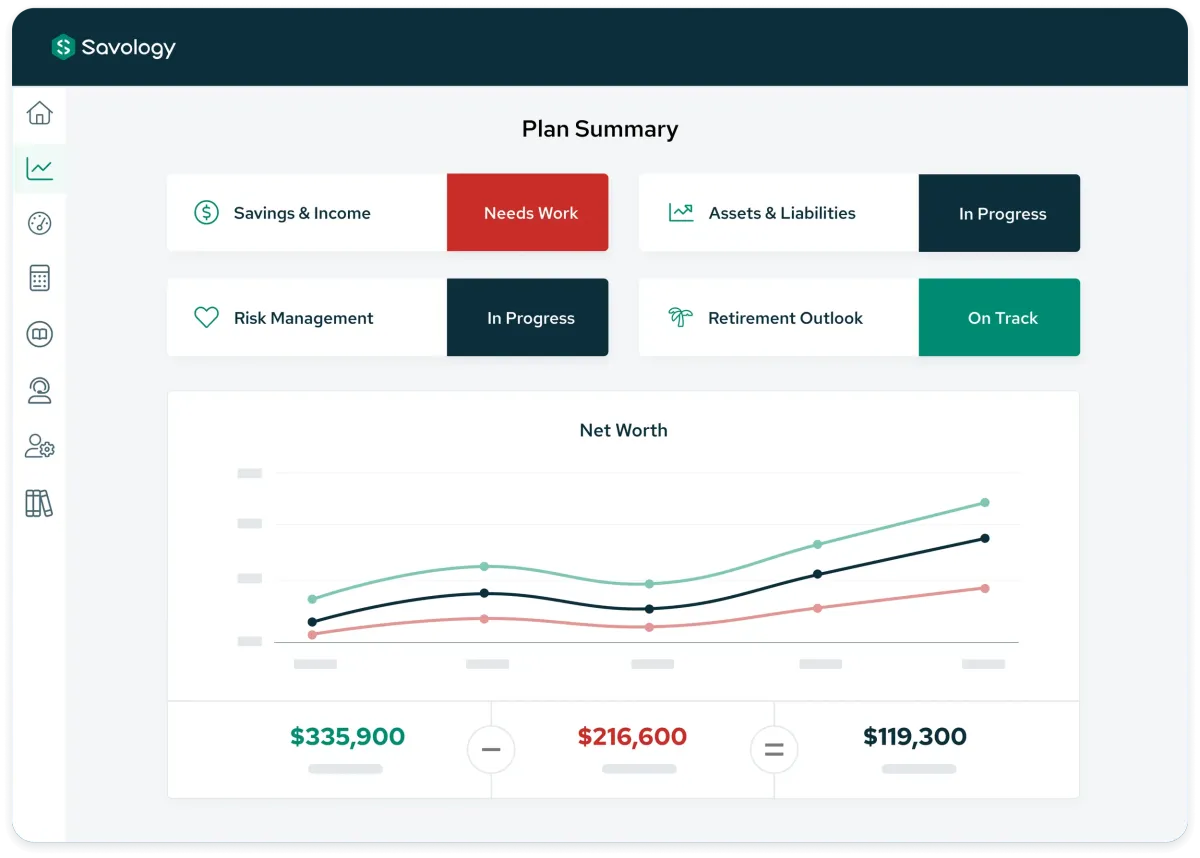

Financial Dashboard & Professional Guidance

We believe physician families deserve a comprehensive financial dashboard and access to professional guides to help them make good decisions.

We offer an unbiased, economical “on-ramp” to financial planning with no advertising or products to sell.

We nurture our clients throughout their financial planning journey and look for opportunities to refer them to our trusted network of specialists when their needs exceed what we offer.

fpGuides™

We’ve built strong partnerships with top university Personal Financial Planning programs to power our Financial Planning Residency Program.

Through this program, we hire, train, support, and pay emerging planners as they work toward becoming Certified Financial Planners®.

fpGuides gain hands-on experience delivering real financial guidance under professional supervision.

They receive ongoing mentorship from experienced CFP® professionals and financial specialists.

This model delivers high-quality, conflict-free financial education and planning support—at scale and at low cost.

Ready To Get Started?

Proud Partners Of

Copyrights 2025 | Direct Wealth Care™ | Terms & Conditions